Key Offerings-

Comprehensive Damage Cover

You may already be aware that Third Party Liability Car Insurance is mandatory as per law. Therefore, if you own a car, you are mandated by law to take up a Third Party Liability Cover. However, taking up a car insurance policy that doesn't compensate your own damages seems pointless, doesn't it? A comprehensive damage cover was developed to offer a broad coverage against all possible damages arising from a variety of risks.

Our comprehensive car insurance policy offers protection against damages caused to your car by way of risks such as collisions, theft, fire, and so on. Additionally, a comprehensive car insurance policy also covers third-party liabilities and offers extensive protection for your car.

Add-On Covers

When it comes to car insurance, additional coverage is always better. You can enhance your vehicle insurance coverage protection further with our wide-range of add-on covers such as-

Nil Depreciation

(UIN: RGI-MO-A00-00-03-V01-13-14)

Depreciation reduces the value of your cover drastically. This add-on cover compensates for the depreciating value of your car. Opt for this and you will not have to bear the losses occurred due to depreciation on all parts except the tyres and tubes. This add-on cover is applicable to the following conditions-

- This add-on covers private cars, with a maximum of two claims in one vehicle insurance policy period

- In case of partial loss, we will settle a claim made for the insured car only if it is repaired by/ at one of our authorised dealers or workshops

- Compulsory Excess will be applicable as per normal practice and Voluntary Deductible will be applicable if you have opted for it

NCB retention cover

Retain your No-Claim Bonus even after you've made claim and continue to enjoy discounted premium up to 50% year-on-year. We offer this add-on for any private car which is 2 years old or above. You can avail this add-on while renewing your previous car insurance policy with us if the value of your car is less than or up to Rs. 10 lakhs. This retainable NCB is applicable to the following conditions-

- The NCB percentage of the vehicle should be 25% and above

- One approved accidental claim is made during your policy period

- The total value of the claim payment made during your car insurance policy period is up to 25% of the value of your car, as mentioned in your policy

- Your policy is renewed with us, within 90 days of its expiry, which is the normal grace period for availing NCB

Consumables Cover

(UIN: RGI-MO-A00-00-04-V01-13-14)

Sometimes, a bunch of seemingly insignificant expenses can create a big dent in your pocket. All expenses incurred on consumable items are covered in case they are damaged due to perils covered our policy. Consumable items such as nuts and bolts, screws, washers, grease, lubricants, clips, AC gas, bearings, distilled water, engine oil, oil filter, fuel filter and break oil are covered. This add-on cover is applicable to the following conditions-

- This add-on covers private cars, with a maximum of two claims in one motor policy period.

- In case of partial loss, we will settle a claim made for the insured vehicle only if it is repaired at one of our authorised dealers or workshops.

Engine Cover

(UIN:RGI-MO-A00-00-06-V01-13-14)

An engine is the heart and soul of your car. The Engine add-on cover offers compensation for expenses incurred while fixing the indirect damage done by water ingression or leakage of lubricating oil leading to loss or damage to-

- Engine Parts

- Differential Parts

- Gear Box Parts

Key Protect Cover

(UIN: RGI-MO-A00-00-05-V01-13-14)

Let's be honest, we have all misplaced or lost our home/vehicle keys at some point in our lives. While we cannot find your keys for you, we can certainly cover the expenses you incur while repairing or replacing your car keys and/or locks and/or lockset. Here are some more details about the Key Protect Cover-

- The coverage will be available only for a maximum of two claims during your motor insurance policy period.

- A claim resulting from burglary or theft should be supported by a First Information Report (FIR) with the police.

- The replaced keys/lock/lockset is of the same nature and kind as the one for which the claim has been made.

- The loss or damage to the keys/lock/lockset is reported to us within 7 days of the loss or damage.

- Replacement of key(s) will be allowed for broken or damaged keys only.

- In case of theft or misplacement of key(s), the entire set comprising of key, lock and lockset will be replaced, subject to the handing over the other key(s) to us.

How to choose the type of insurance that suits you the best?

Now that you understand the nuances of both types of Car Insurance Policies you must be contemplating about which one to choose. Here are some valuable recommendations to help you with your decision-

The

Third Party Liability Car Insurance policy is generally chosen by individuals who want to buy car insurance as it is mandatory by law.

If you seek overall protection from the damages caused due to unforeseen accidents, opting for a

comprehensive car insurance policy is the best option.

Additionally, you can pick

add-on covers as per the risks which are more relevant to you.

Interested in Third-party liability insurance? Click here to know more!

Important car insurance terms you should know-

Information is the key to make the right decisions. To ensure that you make an informed purchase, we have explained the essential car insurance concepts right here-

What is IDV?

The IDV (Insured Declared Value) is the current market value of the car which is calculated after deducting the depreciation amount. It is a crucial component of the car insurance policy as it determines the amount of compensation. In case of theft or total destruction of the car, the IDV is offered as "Sum Insured".

What is No Claim Bonus?

When you don't file a claim during your policy period, you will be eligible for a discount on your next premium which is referred to as a No-Claim Bonus. This discount will keep increasing progressively for each claim-free year until the car insurance premium is reduced up to 50%.

What are the different kinds of add-on covers available?

We offer a wide range of add-on covers to ensure superior protection from a variety of risks. You can opt for add-on covers such as Nil-dep cover (Zero Depreciation), NCB retention cover (avail the NCB despite registering a claim), 24x7 Roadside Assistance, Personal Accident cover (covers personal damages), electrical/electronic accessories cover and many more. Refer to our add-on cover section, for more details.

How will a Zero Depreciation Cover help you?

You may already know that the monetary value of your car reduces overtime. This eventuality is a result of asset depreciation. Nevertheless, with Reliance General Car Insurance policy, you can combat the losses of depreciation by taking up a zero depreciation add-on cover along with your car insurance. With a zero depreciation cover, you can be assured that the entire claim amount will be paid to you without deducting the depreciation sum.

How is a car insurance premium calculated?

Your car insurance premium is calculated based on several factors such as-

- Car Manufacturer and Model

- Cubic capacity (cc)

- Age of the Car

- Insured Declared Value (IDV)

- No Claim Bonus (NCB)

- Tax

Other factors like add-on covers, discounts, purpose of the vehicle and safety features such as airbags and anti-theft devices will also be taken into consideration while calculating your car insurance premium.

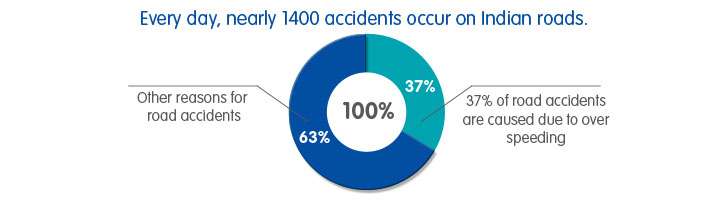

Not sure if you need car insurance? Numbers Don’t Lie!

The poor road conditions and a blatant disregard for traffic regulations make Indian roads one of the most dangerous in the world.

These fatalities are only expected to rise in the future. We don't mean to scare you by these grim statistics. The statistics reflect the kind of dangers that the roads entail. Hence, It's better to be safe than sorry!

How to Save on Car Insurance Policy Premium?

Know Your Car's IDV

The value of your car depreciates overtime. Hence it is important to know your IDV. A lower IDV attracts a lower premium.

Claim Your No Claim Bonus

The No Claim Bonus is your rightful reward for being a responsible driver. Earn discounts of up to 50% on your premium year-on-year.

Install Security Devices

The safer your car, the lower will be the premium. Installing anti-theft devices can fetch you up to 2.5% discount on your car insurance premium.

Become AAI Member

Become a member of the Automobile Association of India and you can secure a concession on personal-damage premium.

Increase the Voluntary Deductible

A Voluntary deductible is the amount you agree to pay out of your pocket. The higher your voluntary deductible, the lesser will be your premium.

What does the policy cover?

If you suffer damages caused due to any of following reasons, we've got you covered!

- Accident

- Explosion

- Earthquake

- Hailstorm

- Terrorism

|

- Fire

- Theft

- Flood

- Frost

- Inundation

|

- Self-Ignition

- Lightening

- Cyclone

- Tempest

- Riot & Strikes

and/or Malicious Acts

|

- Hurricane

- Landslide

- Rockslide

- Typhoon

- Transit by Rail,

Road, Air & Elevator

|

What does the policy not cover?

Providing coverage is just one aspect of our car insurance policy. What if you are stranded due to an accident or car-breakdown in the middle of nowhere? We offer the below mentioned assistance services that will help you out in the times of need-

Add-On Covers

Many car insurance holders are of the opinion that buying add-ons are unnecessary. This is because a car insurance policy offers basic protection against damage and losses to your vehicle, so one might think that add-on covers are avoidable.

When you are on the road, your safety is at risk from a number of factors. So, you should buy add-on covers for your car as they are not just additional cost, but an asset, offering vast range of advantages. At Reliance General Insurance, we want to make sure our car insurance holders can secure the best possible protection for themselves. So choose wisely and secure your car with our assortment of add-on covers.

Motor Secure Plus Cover

(UIN - RGI-MO-A00-00-03-V01-13-14, RGI-MO-A00-00-04-V01-13-14, RGI-MO-A00-00-06-V01-13-14)

For superior risk coverage, we have compiled a mix of add-on covers in a single package. The Motor Secure Plus Cover includes-

- Nil Depreciation Cover

- Consumables Cover

- Engine Cover

Note that automobile insurance coverage is available only for the claims intimated within 7 days of the loss or damage.

Motor Secure Premium Cover

(UIN - RGI-MO-A00-00-03-V01-13-14, RGI-MO-A00-00-04-V01-13-14, RGI-MO-A00-00-05-V01-13-14, RGI-MO-A00-00-06-V01-13-14)

The Motor Secure Premium Cover encapsulates all of the crucial risk factors to offer a comprehensive coverage in a single package. The Motor Secure Premium Cover includes-

- Nil Depreciation Cover

- Engine Cover

- Consumables Cover

- Key Protect Cover – Private Cars

Got some questions? You can call us on 18003009 regarding any queries while buying car insurance online.

Make Your Car Insurance Premium More Affordable with Our Special Discounts

No Claim Bonus

The No Claim Bonus is your rightful reward for being a responsible driver. As our responsible customer, you can enjoy No Claim Bonus which increases progressively on a yearly basis, until the discount reaches a whopping 50%. Here's how it is accumulated on a yearly basis-

|

No. of Years |

Discount |

| One claim-free year | 20% |

| Two consecutive claim-free years | 25% |

| Three consecutive claim-free years | 35% |

| Four consecutive claim-free years | 45% |

| Five consecutive claim-free years | 50% |

Voluntary Deductible

You can avail discounts on your car insurance premium in case you have opted for a voluntary deductible while buying the policy. A Voluntary deductible is a minimum amount that you choose to pay from the claim amount. The higher the Deductible amount, the lower is your auto insurance premium. Please refer to the below table for the applicable Voluntary Deductible-

|

Voluntary Deductible |

Discount |

| Rs 2500 | 20% on the OD premium of the vehicle, subject to a maximum of Rs 750/- |

| Rs 5000 | 25% on the OD premium of the vehicle, subject to a maximum of Rs 1500/- |

| Rs 7500 | 30% on the OD premium of the vehicle, subject to a maximum of Rs 2000/- |

| Rs 15000 | 35% on the OD premium of the vehicle, subject to a maximum of Rs 2500/- |

Additional Discounts

Besides the attractive discounts offered by NCB, you can avail additional discounts on auto insurance in case…

- You are a member of any recognized automobile association

- You have installed an anti-theft device in your car

- You have covered the vehicle for specific location usage

Car Insurance Policy Exclusions

As much as we would like to cover all possible risks, certain situations are just not feasible. We like to maintain complete transparency with our customers. So here's what we don't cover:

- General wear-and-tear of the car

- Cars being used other than in accordance with the limitations as to use. For example, if you use a private car for remuneration purpose.

- Mechanical and electrical breakdown

- Damage to/by person driving without a valid driving license

- Loss or damage caused while driving under the influence of alcohol or any other intoxicating substance

- Loss or damage due to depreciation of the car's value

- Loss or damage due to war or nuclear risks

- Consequential loss - if the original damage causes subsequent damage/loss, only the original damage will be covered under our motor car insurance

- Compulsory deductibles - a fixed amount that gets deducted at the time of the claim

- Depreciation Cover shall not be applicable to theft & total loss claims

We offer comprehensive car insurance plans for various car brands and models.Click here to know more!

We offer car insurance in various Indian cities. We have a wide network of cashless garages all over India.Click here to know more!

*T&C apply. All the Toll Charges will be borne by Customer. Towing Services are free of charges for Garages present with in 25 kms from breakdown location. Towing to Garages beyond a radius of 25 km from breakdown location will be chargeable. Discount is applicable on OD premium. Details mentioned here are for the product- Reliance Private Car Package Policy.